Introduction

Climate change, a mounting global concern, goes beyond geographical and ecological repercussions. It also poses a significant risk to overall financial stability. As extreme weather events increase in frequency and intensity, businesses, governments, and financial institutions are faced with the need to understand and address these climate risks.

The Carbon Disclosure Project (CDP), initially setup in 2000, has established itself as the gold standard of environmental reporting, with the richest and most comprehensive dataset on corporate and city action. The CDP Global Supply Chain Report quantifies the climate risks posed, potentially resulting in revenue losses amounting to $1.26 trillion for suppliers in the forthcoming 5 years. The influence of these factors, in addition to geopolitics, warfare, and inflation, has a significant effect on the financial performance of companies.

Corporate leaders are seeking to alleviate the risks associated with climate change, although this objective presents a complex challenge. Within the realm of climate change, companies face two significant hurdles: an issue with gathering and analysing data, followed by a subsequent problem of making decisions based on this data-driven information.1

To facilitate this and collectively overcome these obstacles, the Bank of International Settlements (BIS) Innovation Hub Eurosystem Centre, together with the Bank of Spain, the Deutsche Bundesbank, and the European Central Bank, have launched Project Gaia, an IA-leveraged platform to enable the comprehensive analysis of climate-related risks in the financial system.

In this article, we will delve into the concept of climate risk analysis within the objectives of Project Gaia and provide an assessment of this innovative research endeavour aimed at illuminating the complexities of climate change for the public good.

Understanding the Factors Influencing Climate Risks

To effectively manage climate risks, it is crucial to identify and assess them accurately. Climate risk analysis involves evaluating both physical risks, such as the immediate impact of extreme weather events, and transition risks, which arise from the long-term shift to a lower-carbon economy.

Physical risks can include damage to infrastructure, disruptions in supply chains, and increased insurance costs. Transition risks, on the other hand, may involve policy changes, technological advancements, or shifts in consumer preferences that can impact the value of certain assets or industries.

When it comes to climate risks, it is crucial to also consider various factors that contribute to their complexity. Geopolitical tensions, armed conflicts, and inflation can all magnify the vulnerability of businesses to climate-related disruptions. For example, political instability in a region may hinder the implementation of effective climate change policies, leaving businesses exposed to greater risks.

The Problem: The Challenge of Accessing Climate-Related Indicators

In today’s business landscape, companies often rely on anecdotal and historical data to make critical operational and strategic decisions. However, this traditional approach falls short when it comes to addressing the impact of climate change and its increasing volatility. As we move forward, it becomes essential to recognise that past occurrences can no longer serve as reliable predictors of the future. In light of this, businesses must adopt a new technique called climate risk analysis to better understand and mitigate potential risks arising from climate change.

Central banks and supervisors are increasingly required to conduct climate risk analysis in order to evaluate the financial system’s vulnerabilities to climate change. In order to carry out these evaluations, they necessitate data that is of superior quality, comparable, and easily accessible.

Nevertheless, these financial institutions and organisations encounter substantial obstacles when trying to obtain valuable climate-related indicators. This impedes effective decision-making and restricts the comprehension of the perils and prospects associated with climate change.

There are numerous obstacles hindering the accessibility of information regarding an institution’s objectives and actions pertaining to climate risks: 2

- The lack of standardisation: ESG reporting gives rise to a multitude of diverse frameworks and metrics, making it arduous to extract and compare ESG indicators across companies and industries.

- Data quality and accuracy: ESG data poses a challenging task, as it typically relies on self-reported information and sometimes on proxies that may be prone to human error, inaccuracies, bias, or a lack of transparency.

- Scope and materiality: The ongoing challenge lies in identifying the ESG factors that are most significant for a company’s performance and should be disclosed, given their variation across industries and contexts.

- Regulatory fragmentation: ESG reporting is complex and fragmented, with different countries and regions having developed their own set of regulations.

The Project Gaia Approach

One notable initiative in the field of climate risk analysis is Project Gaia. Project Gaia is a joint effort between the BIS Innovation Hub Eurosystem Centre, the Bank of Spain, the Deutsche Bundesbank, and the European Central Bank. Its objective is to utilise generative artificial intelligence (AI) in order to enable the examination of climate-related risks within the financial system.

Through the use of advanced modeling techniques and data analysis, Project Gaia provides valuable insights into the potential risks and opportunities associated with climate change. It utilises a scenario-based approach, considering a range of possible climate futures and their corresponding impacts. This approach allows organisations to stress test their portfolios and business strategies against various climate-related scenarios, helping them identify vulnerable areas and develop appropriate risk mitigation measures.

Unlike many other research projects, Project Gaia operates in the public interest and on a not-for-profit basis, emphasising its commitment to advancing scientific knowledge and promoting sustainable solutions.

The Key Components of Project Gaia

To comprehend the impact and potential of Project Gaia fully, it is essential to explore its key components. Firstly, the initiative proposes the development of a universal framework for reporting climate risk-related indicators. This framework will encompass both financial and non-financial data, ensuring comprehensive assessment and analysis. Secondly, Project Gaia emphasises the integration of climate risk analysis into decision-making processes across all sectors. By incorporating climate considerations, businesses can better understand the potential risks their investments and operations may face in the future.

Driving Change through Collaboration and Integration

Project Gaia recognises that addressing climate risks requires collaborative efforts from multiple stakeholders. It encourages partnerships between financial institutions, corporations, regulators, and governments to integrate climate risk analysis into their respective practices. By aligning their efforts, these entities can collectively enhance their understanding of climate-related risks and opportunities, paving the way for more sustainable and resilient decision-making.

Unveiling the Findings

The findings of Project Gaia have far-reaching implications for policymakers, businesses, and communities. By uncovering the potential risks associated with climate change, decision-makers can develop strategies to mitigate these risks, adapt to changing conditions, and build a more resilient future.

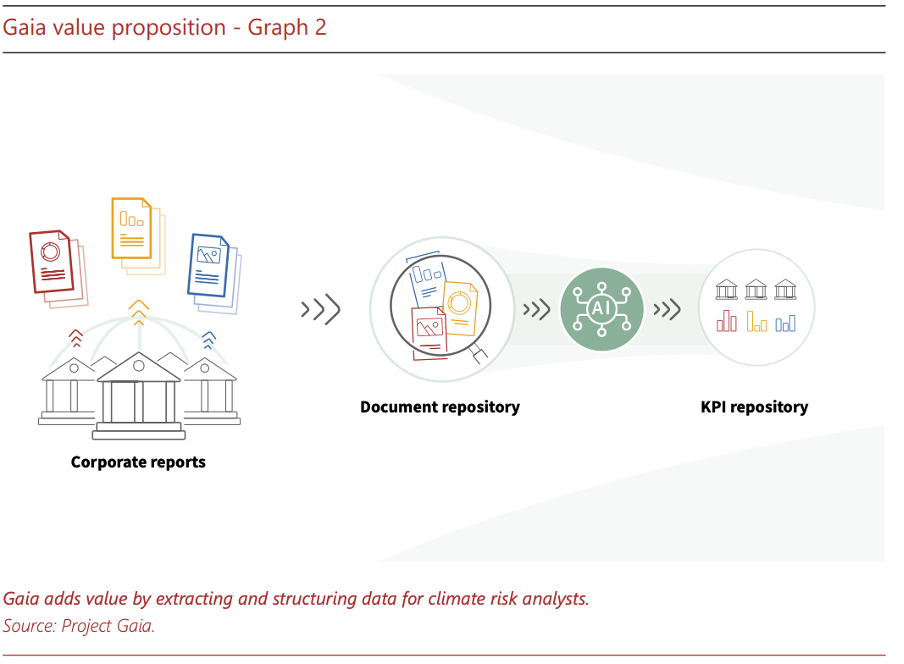

The Project Gaia initiative has successfully demonstrated the viability of utilising AI and machine learning algorithms to analyse financial risks associated with climate change. Through accessing publicly available information, Gaia presents an effective and trustworthy means of obtaining climate risk-related data.

Gaia demonstrates the emerging potential of utilising LLM for data extraction. This project serves as an early illustration of its feasibility and exploration of its capabilities on a large scale.

Conclusion: Taking Action for a Resilient Future

The financial implications of climate change are undeniable. Climate risk analysis provides a valuable tool for organisations to assess and manage these risks effectively. By embracing initiatives like Project Gaia and integrating climate risk analysis into their strategies, businesses and financial institutions can make informed decisions that contribute to a resilient and sustainable future.

It is time for stakeholders across all sectors to collaborate and take concrete actions in addressing climate risks. By utilising climate risk analysis frameworks and engaging in transparent reporting, we can foster a financially stable environment that is resilient to the challenges posed by climate change. Together, let us work towards building a climate-resilient economy for generations to come.

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()