Einleitung

Während sich die Welt auf die 28. UN-Klimakonferenz (COP28) vorbereitet, werden wir daran erinnert, dass wir in unserem gemeinsamen Kampf gegen den Klimawandel an einem entscheidenden Punkt angelangt sind. Fast acht Jahre nach dem historischen Pariser Abkommen steht die COP28 ganz im Zeichen der ersten „Global Stock Take” – einer umfassenden Bewertung der weltweiten Fortschritte und einem Aufruf zu entschlosseneren Klimaschutzmaßnahmen.

Die globale Bestandsaufnahme ist ein zweijähriger Prozess, der alle fünf Jahre abgeschlossen werden soll. Die erste globale Bestandsaufnahme begann im Jahr 2022 und wird mit der bevorstehenden COP28-Konferenz abgeschlossen. Ziel dieses globalen Treffens ist es, die nationalen Klimaschutzbemühungen zu koordinieren, einschließlich Maßnahmen zur Schließung von Lücken.

Die vorläufigen Ergebnisse der globalen Bestandsaufnahme zeigen, dass die Weltgemeinschaft bei der Erreichung der im Pariser Abkommen festgelegten Ziele hinterherhinkt. Das oberste Ziel ist es, die globale Erwärmung unter 2 °C zu halten und gleichzeitig Anstrengungen zu unternehmen, um 1,5 °C nicht zu überschreiten.

Im Mittelpunkt der COP28-Konferenz in Dubai, Vereinigte Arabische Emirate, wird stehen, wie die Nationen die Ergebnisse des Global Stock Take Reports nutzen, um den Auswirkungen des Klimawandels zu begegnen und das globale Ziel der Begrenzung des Temperaturanstiegs auf 1,5 °C aufrechtzuerhalten.

Rückblick auf das Pariser Abkommen:

Das Pariser Abkommen, das 2015 auf der COP21 verabschiedet wurde, war ein Meilenstein in der internationalen Klimapolitik, da sich die Länder erstmals dazu verpflichtet haben, den globalen Temperaturanstieg deutlich unter 2 °C zu begrenzen. Der Geist der Zusammenarbeit war spürbar, als Regierungen und nichtstaatliche Akteure aus aller Welt sich in einer beispiellosen Verpflichtung für eine nachhaltige Zukunft zusammenschlossen. Aufgrund seines globalen Charakters und seiner Komplexität hängt die Bekämpfung des Klimawandels von der Fähigkeit der Länder ab, gemeinsam Lösungen in der erforderlichen Größenordnung zu finden. Zusammenarbeit ist ein entscheidender Faktor für die Wirksamkeit von Umweltabkommen.

Die globale Bestandsaufnahme unterstreicht die Dringlichkeit von Maßnahmen zur Eindämmung der globalen Erwärmung. Internationale Zusammenarbeit, gerechte Klimaschutzmaßnahmen und eine nachhaltige Transformation in allen Sektoren sind heute wichtiger denn je.

Wie ist der Stand der Netto-Null-Transition in den verschiedenen Sektoren weltweit?

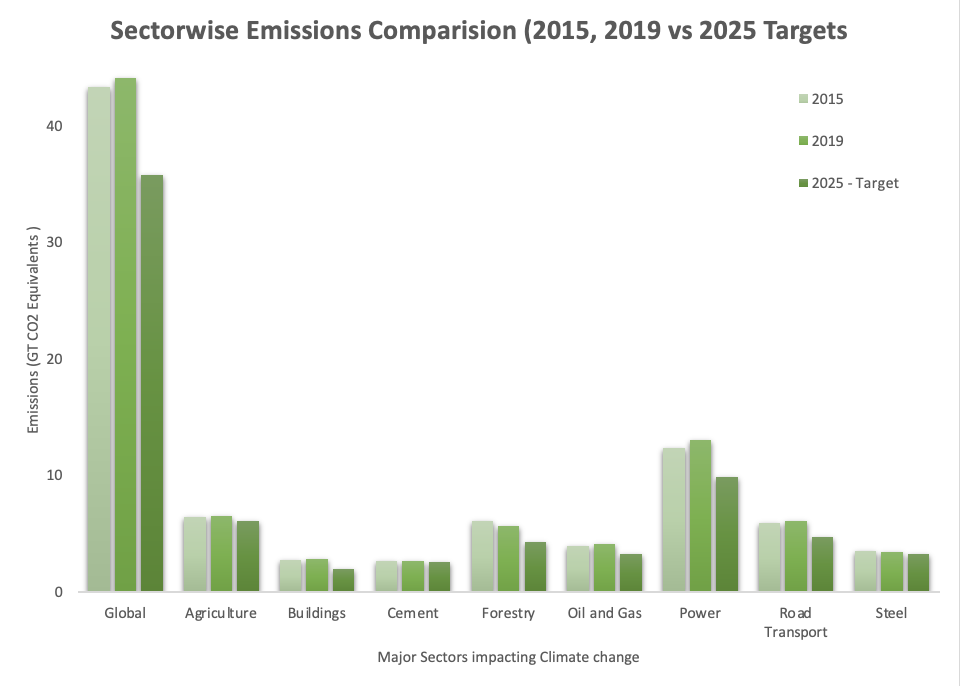

Laut dem McKinsey Emissions Tracker (2019) und in Übereinstimmung mit der 1,5 °C-Szenarioanalyse entfielen auf die zehn im Tracker erfassten Sektoren – Strom, Straßenverkehr, Seeverkehr, Luftverkehr, Öl und Gas, Stahl, Zement, Gebäude, Landwirtschaft und Forstwirtschaft – allein im Jahr 2019 rund 80 % der weltweiten Treibhausgasemissionen, wie unten dargestellt. Diese Ergebnisse zeigen deutlich, dass die Emissionen in den meisten Sektoren gestiegen sind und sich die Lücke zum Ziel vergrößert hat, mit Ausnahme der Forstwirtschaft, wo die Emissionen zwar zurückgegangen sind, jedoch nicht im angestrebten Umfang, und der Stahlindustrie, die ebenfalls einen Rückgang der Emissionen verzeichnete.

Abbildung 1: Vergleich der Emissionen nach Sektoren für 2015, 2019 und 2025

- Nicht-CO2-Emissionen werden entsprechend ihrem 100-jährigen Treibhauspotenzial (GWP100) in Kohlendioxidäquivalente umgerechnet.

- Emissionen auf 5 MtCO2-Äquivalente gerundet.

- Quelle: McKinsey Emissions Inventories Tracker, McKinsey 1,5 °C-Szenarioanalyse

Die Bewertung der Fortschritte auf sektoraler Ebene bei der Reduzierung der globalen Emissionen ist eine komplexe Herausforderung. Ein nützlicher Rahmen für die Bewältigung dieses Problems berücksichtigt neun entscheidende Elemente. Diese Elemente sind in drei Kategorien unterteilt: Physische Bausteine, wirtschaftliche und gesellschaftliche Anpassungen und Governance:

Physical Building Blocks

- Technological advancements

- Creating supporting infrastructure

- Availability of essential natural resources

Economic and Societal Adjustments

- Efficient capital reallocation and financing models

- Managing demand shifts and initial increases in unit costs

- Creating compensatory measures to mitigate socioeconomic effects.

Governance:

- Setting governing standards, tracking, market mechanisms, and strong institutions

- Commitment and cooperation among leaders from public, private, and social sectors worldwide

- Gaining support from citizens and consumers.

Physische Bausteine

- Technologische Fortschritte

- Schaffung einer unterstützenden Infrastruktur

- Verfügbarkeit wesentlicher natürlicher Ressourcen

Wirtschaftliche und gesellschaftliche Anpassungen

- Effiziente Kapitalumschichtung und Finanzierungsmodelle

- Bewältigung von Nachfrageverschiebungen und anfänglichen Steigerungen der Stückkosten

- Schaffung von Ausgleichsmaßnahmen zur Abmilderung sozioökonomischer Auswirkungen.

Governance:

- Festlegung von Regulierungsstandards, Überwachung, Marktmechanismen und starke Institutionen

- Engagement und Zusammenarbeit zwischen Führungskräften aus dem öffentlichen, privaten und sozialen Sektor weltweit

- Gewinnung der Unterstützung von Bürgern und Verbrauchern.

Abbildung 2: Ein Rahmen für einen geordneten Übergang zu einer Netto-Null-Zukunft (Quelle: McKinsey and Company, 2021)

Vor diesem Hintergrund sind die weltweiten Fortschritte und die Bereitschaft für den Übergang zur Netto-Null offensichtlich hinter dem Zeitplan zurück, doch gibt es in der Kategorie der physischen Bausteine ein bemerkenswertes Potenzial. Die Analyse der Ergebnisse dieser vorläufigen Bewertung liefert drei wichtige Erkenntnisse, die die Dringlichkeit sofortiger Maßnahmen unterstreichen und Unterschiede zwischen verschiedenen Sektoren und Anforderungen aufzeigen:

- Die Fortschritte auf dem Weg zur Erreichung der Netto-Null-Emissionen bis 2050 sind rückständig, und die Welt riskiert weitere Verzögerungen. Die derzeitigen Bemühungen zur Emissionsreduzierung weisen eine erhebliche Lücke gegenüber den erforderlichen Werten auf, um die Netto-Null bis zum Zieljahr zu erreichen. Insgesamt scheint die weltweite Bereitschaft für diesen Übergang nur etwa ein Drittel bis die Hälfte dessen zu betragen, was für einen reibungsloseren Übergang erforderlich ist, insbesondere wenn die verschiedenen Kriterien gleich gewichtet werden. Diese Lücke könnte sich vergrößern, wenn Faktoren wie die Finanzierung stärker berücksichtigt werden. Dennoch weisen einige Bereiche innerhalb der neun Kriterien vielversprechende Stärken auf.

- Die Umsetzung technologischer Fortschritte auf dem Weg zur Netto-Null-Transition erfordert eine koordinierte Unterstützung in mehreren Schlüsselbereichen, darunter vor allem erweiterbare Lieferketten und die Verfügbarkeit solider Finanzmittel. Darüber hinaus sind die Bereitschaft und das Engagement sowohl der Unternehmen als auch der Verbraucher erforderlich, um den Übergang zu erleichtern. Dazu gehören weitere technologische Fortschritte und verschiedene Strategien zur Kostensenkung, zur Überbrückung der Leistungslücke gegenüber herkömmlichen Optionen und in einigen Fällen die Fähigkeit, zusätzliche Kosten zu tragen.

- Die Beteiligten können sofort Maßnahmen ergreifen, die nicht nur Emissionen senken und die Widerstandsfähigkeit erhöhen, sondern auch eine reibungslosere Energiewende ermöglichen. Trotz der kurz- und langfristigen Herausforderungen auf dem Weg zur Netto-Null-Emissionswirtschaft gibt es mehrere klare und unmittelbare Chancen, die Führungskräfte jetzt nutzen können, um den Übergang zu beschleunigen. Diese Chancen sind relativ einfach umzusetzen und tragen oft dazu bei, Emissionen zu reduzieren, Kosten zu senken und die Energieversorgungssicherheit zu verbessern. Beispiele hierfür sind Initiativen zur Verbesserung der Energieeffizienz (z. B. im Gebäudesektor oder in der Industrie), die Förderung der Kreislaufwirtschaft zur Verringerung des Energie- und Materialverbrauchs sowie Maßnahmen zur Reduzierung der Methanemissionen bei der derzeitigen Nutzung fossiler Brennstoffe. Diese Maßnahmen sind besonders wichtig, wenn man bedenkt, wie viel Zeit erforderlich ist, um ausreichend Kapital aus emissionsintensiven in emissionsarme Anlagen in verschiedenen Branchen zu transferieren

Die Bedeutung der COP28:

Die erste globale Bestandsaufnahme, die kürzlich im Oktober 2023 veröffentlicht wurde, zeigt, dass die Welt hinter den Zielen des Pariser Abkommens von 2015 zurückliegt. Auf der COP28 werden die UN-Mitgliedstaaten ihre individuellen und kollektiven Antworten auf die Ergebnisse der Bestandsaufnahme weiter ausarbeiten. Diese Diskussionen werden voraussichtlich zu folgenden Ergebnissen führen:

- Es werden konkrete Ziele für den gesamten Energiesektor (einschließlich Solar- und Windenergie, Kohle, Wasserstoff, Öl und Gas) vereinbart. Die globale Bestandsaufnahme betont nachdrücklich die Bedeutung einer globalen Energiewende für die Erreichung der Netto-Null-Emissionsziele und unterstreicht, wie wichtig es ist, während dieses Prozesses konkrete Ziele für den Energiesektor festzulegen.

- Es werden skalierbare Finanzierungsmechanismen zur Erleichterung der globalen Klimaschutzbemühungen eingerichtet, insbesondere für die am stärksten gefährdeten Länder, da die Mitgliedstaaten die Lücken in den Maßnahmen und deren Umsetzung erkennen, die direkt auf finanzielle Zwänge zurückzuführen sind.

- Es werden Strategien entwickelt, um den globalen Privatsektor in die Klimaschutzmaßnahmen einzubeziehen (einschließlich Finanzierung, Rechenschaftspflicht, Kapazitätsaufbau und Technologie).

- Aufruf an die Mitgliedstaaten, ihre Maßnahmen zur Erreichung ihrer national festgelegten Beiträge zu verstärken, wobei Gerechtigkeit und historische Verantwortung, insbesondere der Industrieländer, Vorrang eingeräumt werden.

Bis zum Ende der COP28 müssen sich die Länder darauf einigen, wie sie die Ergebnisse der Bestandsaufnahme nutzen werden, um das globale Ziel der Begrenzung des Temperaturanstiegs auf 1,5 °C aufrechtzuerhalten und die Auswirkungen des Klimawandels zu bewältigen.

Schwerpunkte der COP28:

1. Verabschiedung einer transformativen Reaktion auf die globale Bestandsaufnahme:

Mit der COP28 geht die Bestandsaufnahme von einer technischen in eine politische Phase über. Es ist von entscheidender Bedeutung, dass die Länder nicht nur Lücken bei den Maßnahmen und der Finanzierung erkennen, sondern auch klare und ehrgeizige Schritte für die Zukunft festlegen.

2. Beschleunigung des Systemwandels:

Die COP28 muss sich mit der dringenden Notwendigkeit einer Transformation der globalen Systeme befassen und insbesondere das Ende des Zeitalters der fossilen Brennstoffe signalisieren. Diskussionen über den Ausstieg oder die schrittweise Reduzierung fossiler Brennstoffe und die Rolle von Technologien zur Kohlenstoffabscheidung stehen im Mittelpunkt dieser Transformationen.

3. Stärkung der Klimafinanzierungszusagen:

Eine angemessene finanzielle Unterstützung für Entwicklungsländer ist von entscheidender Bedeutung. Die COP28 sollte sich darauf konzentrieren, die Zusage einer jährlichen Klimafinanzierung in Höhe von 100 Milliarden US-Dollar zu bekräftigen und auszuweiten sowie die Diskussionen über die Finanzierung von Verlusten und Schäden voranzutreiben.

4. Verbesserung der globalen Zusammenarbeit für Anpassung und Resilienz:

Investitionen in Anpassungs- und Resilienzstrategien sind unerlässlich, insbesondere für gefährdete Regionen. Die COP28 sollte Rahmenbedingungen für die globale Zusammenarbeit bei der Integration von Anpassungsmaßnahmen in die Klimapolitik fördern.

Wie wirkt sich der globale Übergang zur Netto-Null auf die Akteure der Finanzbranche aus?

Die weltweiten Bemühungen um eine Netto-Null-Transition werden sich, angestoßen durch Ereignisse wie die COP28, weiter konkretisieren. Allerdings sind die Portfolios von Finanzinstituten insgesamt zunehmend Klimarisiken ausgesetzt und nutzen Stresstests, um ihre Klimarisiken effektiv zu messen. Im vergangenen Jahr haben bedeutende Institutionen erhebliche Fortschritte bei der Entwicklung von Rahmenwerken für Klimarisiko-Stresstests erzielt. Laut dem Bericht der Europäischen Zentralbank vom November 2021 hatten nur etwa 25 % der Institutionen Ad-hoc-Stresstests, Szenarioanalysen oder Sensitivitätsanalysen im Zusammenhang mit Klimarisiken durchgeführt. Darüber hinaus hatten lediglich 13 % damit begonnen, Klimarisiken in ihre regulären Stresstest-Rahmenwerke zu integrieren.

Bis Ende 2021 gaben jedoch laut den Ergebnissen des Klimastresstests 2022 (CST) etwa 40 % der Banken an, zum 31. Dezember 2021 über einen Rahmen für Klimarisikostresstests zu verfügen. Die Teilnahme am CST 2022 könnte viele Institute dazu veranlasst haben, Klimarisiken umfassender in ihre Stresstest-Rahmenwerke zu integrieren. Trotz dieser Fortschritte und unter Berücksichtigung der voraussichtlichen Unterschiede in der Gründlichkeit und Vollständigkeit der Stresstestverfahren der Banken haben die meisten Institute noch immer kein Rahmenwerk für Klimarisikostresstests vollständig in ihren Prozess zur internen Kapitaladäquanzbeurteilung (ICAAP) und ihre umfassenderen Stresstestverfahren integriert.

Wir bei Aspect Advisory sind uns der Dringlichkeit bewusst, die in der globalen Bestandsaufnahme hervorgehoben wurde, und wissen, wie Klimarisikostresstests den weltweiten Übergang zu Netto-Null-Emissionen erleichtern. Unsere ESG-Praxis, insbesondere im Bereich der Klimarisiko-Stresstests, steht im Einklang mit diesen globalen Prioritäten, indem sie unseren Kunden einen Überblick über das Ausmaß der Klimarisiken ihrer Portfolios verschafft und so ein gezieltes Risikomanagement und eine Optimierung ermöglicht. Wir sind bestrebt, unsere Kunden durch dieses sich schnell verändernde Umfeld zu begleiten und sicherzustellen, dass ihre Strategien robust, nachhaltig und zukunftsorientiert sind.

Fazit

Die COP28 ist mehr als nur eine weitere Konferenz – sie ist ein entscheidender Moment, um globale Klimaschutzmaßnahmen voranzutreiben. In den letzten zehn Jahren sind die Kosten für erneuerbare Energiequellen erheblich gesunken: Windenergie ist um 70 % billiger geworden, und Solarenergie hat einen Preisrückgang von 90 % verzeichnet. Auch in der globalen Politik gibt es einen spürbaren Wandel im Umgang mit dem Klimawandel. Politiker setzen sich nun aktiv für dieses Thema ein und wenden sich von ihrer früheren Tendenz ab, es zu ignorieren oder zu leugnen. Die Verabschiedung des Klimagesetzes durch den US-Kongress, die einst als unwahrscheinlich galt, markiert einen bedeutenden Wandel.

Zwar kann man weiterhin alarmierende Prognosen über eine vom Klimawandel geprägte Zukunft hervorheben, doch es zeichnet sich auch eine hoffnungsvollere Entwicklung ab. Wir befinden uns an einem einzigartigen Punkt in der Geschichte der Menschheit und haben die Chance, den Klimawandel zu bekämpfen und seine schlimmsten Folgen abzuwenden. Es gibt viele Gründe, optimistisch in die Zukunft unseres Klimas zu blicken. Der Erfolg der COP28 hängt von gemeinsamen Anstrengungen ab, transformative Veränderungen in allen Sektoren zu vollziehen, die durch eine verstärkte Zusammenarbeit und Finanzierung untermauert werden. Es ist ein Aufruf an uns alle, uns der Herausforderung zu stellen und unsere Ambitionen in konkrete Maßnahmen für eine nachhaltige Zukunft umzusetzen.

Quellen:

- Mckinsey & Company (2023), „What is the global stock take?”

- Rahmenübereinkommen der Vereinten Nationen über Klimaänderungen (2023) „Warum ist die globale Bestandsaufnahme für den Klimaschutz in diesem Jahrzehnt so wichtig?”

- International Institute for Sustainable Development (2023), UN-Klimakonferenz 2023 (UNFCCC COP 28)

- Mckinsey & Company (2023), Ein Sektor-Fortschrittsanzeiger für den Übergang zur Netto-Null

- Europäische Zentralbank (2022), Klimarisikostresstest 2022

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()