1. Introduction

All banks are now dependent on models, making model risk one of the fastest-growing risks facing the banking industry today. As financial institutions rely more on predictive analytics to guide critical decisions, managing model risk effectively has never been more crucial. Model Risk Management (MRM) helps manage operational, reputational, and regulatory risks by ensuring that models are transparent, reliable, and aligned with business and compliance objectives.

For instance, JPMorgan Chase improved its MRM framework by adopting a centralised model governance structure, which reduced model validation time by 30% and enhanced regulatory compliance [1]. This example underscores the importance of a structured and strategic approach to MRM.

This article will explore the four foundational pillars of optimising and digitalising MRM to strengthen model lifecycle governance and enhance institutional resilience, in line with supervisory expectations such as SR 11-7 and the EBA Guidelines on Model Risk Management.

2. Model Inventory and Registry

The foundation of MRM governance

A robust MRM framework starts with a comprehensive model inventory and a digital model registry to support lifecycle governance. While these two terms are sometimes used interchangeably, they serve distinct but complementary purposes.

- The model inventory is the complete, organisation-wide catalogue of all models in use – including regulatory, business, and AI/ML models. As per EBA Guidelines, the inventory should include metadata like model ID, tier, owner, purpose, usage, and validation status. This ensures transparency and oversight across the organisation.

- The model registry, on the other hand, goes a step further. It is typically implemented as a digital tool that supports the full model lifecycle, enabling:

- Version control and change history

- Governance workflows and approvals

- Validation status tracking

- Integration with performance monitoring and data pipelines

- Storage and visualisation of model metadata, lineage, and dependencies

Core Components of an Effective Registry

A well-organised model registry is central to MRM success, supporting collaboration, auditability, and continuous compliance. Key components include:

- Model Identification and Categorisation: Ensure every model is uniquely identified and classified by type (e.g. credit, market, operational) and tier (based on materiality).

- Metadata and Lineage Tracking: Capture detailed metadata and data lineage to trace inputs, transformations, and outputs across the model lifecycle – especially important in the EU regulatory context.

- Defined Validation Metrics: Establish clear standardised validation thresholds, KPIs, and performance metrics by model type and tier..

- Ownership and Accountability: Governance roles should be clearly defined, with accountability distributed across the MRM team, Model Validation Team, Model Development Team, and business owners.

Model Tiering

Categorising models based on their materiality, complexity, and impact is essential for prioritising resources. Tiering criteria may include:

- Regulatory significance (e.g. Basel/IFRS 9 models)

- Model usage frequency

- Business criticality

- Financial exposure

- Complexity of methodology or input data

Models are assigned to tiers from 1 to 3, where Tier 1 models are critical to decision-making and carry significant financial or reputational risk. Tier 3 models are less impactful and used internally only.

Tiering informs the intensity of model monitoring and documentation expectations, which ties directly into the proportionality principle set out in the EBA Guidelines. The tiering should be reviewed regularly, especially as model usage or business context evolves. This structured approach ensures that resources are efficiently allocated, promoting robust validation, governance, and monitoring practices where they are most needed.

3. Standardised Validation and Monitoring Principles

Consistency is key

A scalable MRM framework requires standardised validation and monitoring processes. This ensures transparency, regulatory compliance, and comparability across all model types.

- Uniform Validation Standards: Align with internal policies and supervisory expectations such as the EBA Guidelines, which call for ‘sound model validation, independent review, and proportionality based on model materiality.’

- Transparent Documentation: Each model’s development, limitations, and approval rationale should be fully traceable.

- Defined Governance Structure: Clear roles across the three lines of defence are essential. MRM and Model Validation Units should lead oversight, while business units remain accountable for appropriate use.

Relevant Regulatory Standards

Key regulatory standards to align with include:

- Basel II/III

- SR 11-7 (U.S. Federal Reserve)

- EBA Guidelines (including IRRBB and ICAAP/ILAAP)

- GDPR & CCPA (for data privacy)

- IFRS 9 / CECL (credit risk and loss provisioning)

Common Model Types

Some of the most common model types include:

- Credit Risk: PD, LGD, EAD

- Market Risk: VaR, CVaR

- Fraud & AML: ML-based detection

- Operational Risk: Scenario modelling

- Pricing Models: Risk-based pricing

- Strategic Planning Models: ICAAP/ILAAP stress testing and scenario analysis

- AI/ML Models: Requiring governance over explainability, bias, data drift, and ethical use

4. Strong Data Processes

Data is the backbone of every model

Poor data quality is one of the leading sources of model risk. Furthermore, institutions face increasing complexity in integrating legacy systems and securing sensitive data. A resilient MRM framework requires well-governed, high-quality and accessible data pipelines to support model development and performance monitoring.

Best practices for strong data processes

- Integrated Systems: Link legacy and modern systems through secure APIs and cloud-native platforms.

- Data Governance: Assign clear data ownership and establish version-controlled input/output datasets stored centrally for traceability.

- Data Lineage and Metadata Management: Track data origins, transformations, and usage across each model lifecycle.

- Quality Assurance: Implement validation rules, automated cleansing, and reconciliation processes to ensure data accuracy.

- Data Privacy & Security: Ensure compliance with GDPR/CCPA through encryption and access management.

- Scalable Infrastructure: Employ data lakes and real-time streaming to support large-scale modelling needs.

Example: API-Driven Credit Rating Integration

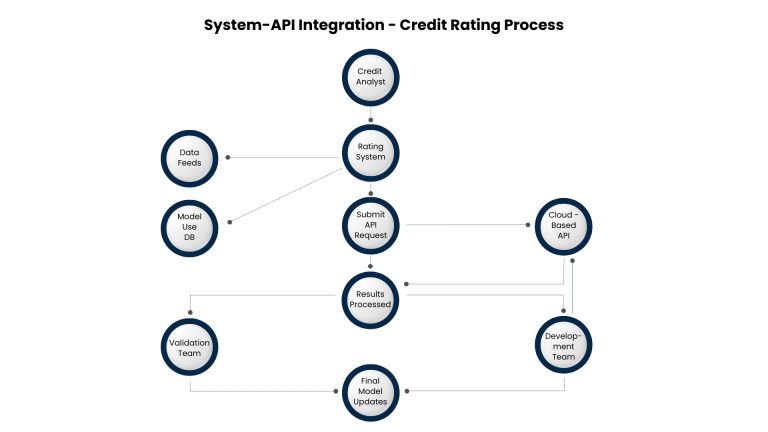

Figure 1 illustrates how financial institutions integrate APIs for automated credit scoring – from ingesting real-time financial data to validating outputs via standardised KPIs. The benefits of implementing this approach include:

- Real-time data ingestion and historical insights

- Seamless integration with internal systems

- Automated and centralised validation and model oversight

Selected Case Studies

1. Loan Default Model Deployment via API for Credit Risk Assessment

Mutually Human developed a machine learning-based loan default model to assess default probability. This model was deployed via an API, enabling real-time scoring of loan applicants’ creditworthiness. The integration allowed financial institutions to make informed lending decisions efficiently, enhancing their credit risk management processes. [2]

2. API Integration for Automating Payments and Underwriting in Banking

Sun Technologies implemented API integrations to automate payment back-office tasks, including underwriting, collateral management, and credit checks. By integrating these APIs, the bank streamlined its workflows, reduced manual efforts, and improved compliance with regulatory standards. [3]

3. Integration of S&P Global Ratings into Tech Feed Provider’s API Solutions

A technology feed provider incorporated S&P Global Ratings into its cloud-based API delivery, offering end clients direct access to credit ratings. This integration facilitated seamless access to essential credit information, enhancing the clients’ decision-making processes. [4]

5. Empowered Model Validation Teams

Stronger validation teams are essential

Effective model validation teams face capacity and coordination challenges that can hinder MRM success.

Common Challenges

- Incomplete or inconsistent documentation

- Low data quality or lack of lineage

- Limited automation in monitoring

- Unclear ownership between developers and risk teams

- Pressure from tightening regulatory timelines

Improvement Strategies

- Standardised Workflows: Use consistent validation templates and documentation standards.

- Monitoring Automation: Implement ML-driven alerting for model drift and performance decay.

- Dashboards: Real-time visualisation of risk thresholds, tier-based KPIs, and breach alerts.

- Role Clarity: Define responsibilities clearly between developers, business users, and validators.

- Centralised Audit Trail: Use a model registry that captures validation status, governance controls, approvals, and monitoring history.

- MLOps/ModelOps Integration: As AI and ML models become more prominent, firms should incorporate principles from MLOps to manage continuous integration, deployment, and monitoring of models. This enables validation teams to stay ahead of drift, model reuse, and ethical concerns.

6. Conclusion & Outlook

As models grow more complex and regulatory scrutiny intensifies, financial institutions must proactively strengthen their MRM frameworks with digitalisation and structured governance. The scope of MRM is rapidly expanding, encompassing traditional risk models, AI models, and strategic forecasting tools embedded in ICAAP/ILAAP. With increasing focus on explainability, data lineage, ethical use, and stress testing, MRM teams must future-proof their frameworks with scalable tools and clear governance.

A future-proof MRM approach is not only compliant with regulation, but leads to the following benefits:

- Reduced costs

- Decreased risks

- Improved transparency and compliance

- Optimized performance and operational efficiency

About Aspect Advisory

At Aspect Advisory, we’ve helped institutions across Europe and Africa design and implement practical, risk-aligned MRM solutions – from model lifecycle frameworks to data pipelines and automated validation tools. We support financial institutions in building robust, end-to-end Model Risk Management solutions. Our offerings include:

- Model development, validation, and governance

- AI/ML-based monitoring and automation tools

- Regulatory alignment with Basel, SR 11-7, GDPR

- Customised governance and lifecycle frameworks

- Strategic data infrastructure design

Partnering with Aspect Advisory empowers institutions to navigate complexity with confidence and achieve sustainable success in managing model risk.

Sources:

- JPMorgan Chase MRM Optimization – Business Insider, 2023

https://www.businessinsider.com/aws-wall-street-jpmorgan-bridgewater-mufg-rocket-mortgage-2025-2 - Mutually Human – Credit Risk API Case Study

https://www.mutuallyhuman.com/case_studies/deploying-a-loan-default-model-via-api-for-credit-risk-assessment - Sun Technologies – API Automation in Banking

https://www.suntechnologies.com/case-study/api-integration-to-automate-payments-underwriting-tasks-and-orchestrate-new-banking-process-workflows - S&P Global – Ratings API Integration

https://www.spglobal.com/market-intelligence/en/news-insights/research/a-tech-feed-provider-adds-sp-global-ratings-to-its-api-solutions

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()