1. Introduction

The financial services industry proved to be a bellwether for economic health and innovation in 2024. Despite challenges such as geopolitical tensions, regulatory shifts, and rapid technological advancements, the sector displayed remarkable resilience. Key achievements included:

- Navigating Complex Geopolitical Risks: Institutions adapted to global uncertainties, ensuring financial stability and market responsiveness.

- Sustainability Leadership: Adoption of ESG frameworks and compliance with the EU Corporate Sustainability Reporting Directive (CSRD) emphasized a commitment to transparency and green finance.

- Technological Evolution: Increased integration of AI, blockchain, and digital payment solutions reshaped operations and enhanced customer experiences.

- Regulatory Agility: Firms successfully adapted to stricter anti-money laundering (AML) measures and data protection laws.

As we step into 2025, the year promises to be pivotal, building on the resilience demonstrated in 2024 and embracing opportunities for innovation and growth. Several key trends are set to shape the industry’s future, offering insights and challenges for those ready to adapt.

Additionally, the transition to a new White House administration in early 2025 introduces the possibility of shifts in global financial policies. While there is currently no immediate impact, financial institutions should remain vigilant to potential regulatory changes, trade agreements, and sustainability policies that could influence the market landscape. Here’s what to watch for in the year ahead.

2. Technology Revolutionising Financial Services

“AI and machine learning are no longer optional but critical tools in staying competitive,” Christian Sewing, CEO of Deutsche Bank, in a statement about their 2024 AI strategy.

Technology remains at the heart of transformation in financial services. In 2025, artificial intelligence (AI) and machine learning will further penetrate the sector, enabling personalised customer experiences, fraud detection, and predictive analytics for investment strategies. For instance, Deutsche Bank partnered with Google Cloud in 2024 to enhance its AI capabilities, improving operational efficiency and customer interactions. Open banking is set to expand, fostering greater collaboration between traditional banks and fintech companies like Revolut and N26, which continue to innovate in customer-centric services. Additionally, blockchain technology is gaining traction for secure and transparent transactions, with applications such as HSBC’s successful pilot of blockchain-based trade finance in 2024.

3. The Rise of Sustainable Finance

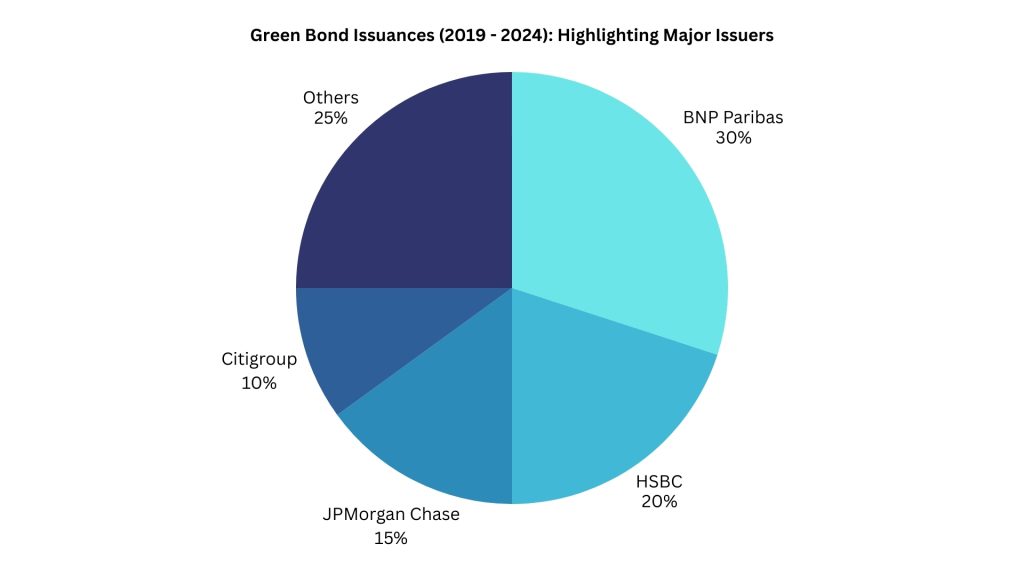

Environmental, social, and governance (ESG) considerations are no longer optional but essential for financial institutions. In 2024, BNP Paribas issued a record-breaking $10 billion in green bonds, reflecting the accelerating demand for sustainable investment options. The demand for green bonds, sustainability-linked loans, and renewable energy investments is accelerating. Financial firms are also embedding sustainability into their core strategies, reflecting regulatory requirements and consumer expectations. Institutions that can align profitability with positive environmental impact are likely to lead the market.

Graph 1: Showcases the growth of green bonds from 2019 to 2024, with BNP Paribas and other major issuers highlighted.

There are now more than 30 different sustainability reporting frameworks available, each with its own set of guidelines and metrics. This variety can be overwhelming for companies trying to determine which frameworks to adopt. Stock exchanges and regulators have played a significant role in this evolution by developing sustainability and climate disclosure regulations. For instance, according to the UN Sustainability Stock Exchanges database, mandatory disclosure rules are now enforced in 27 markets. This rapid development makes it challenging for organisations to stay up-to-date with evolving requirements.

4. Regulatory Adjustments Shaping Strategy

“The regulatory environment in 2025 demands a delicate balance between innovation and compliance,” Karen Maguire, Senior Analyst at ESMA, during a 2024 financial conference.

Regulation will continue to play a pivotal role in shaping the financial landscape. The implementation of IFRS 17, liquidity management tools for open-ended investment funds, and leverage limits for loan-originating funds are set to redefine compliance and operational strategies. In 2024, the European Securities and Markets Authority (ESMA) introduced enhanced liquidity stress testing guidelines, prompting firms like BlackRock to revise their fund management practices to ensure compliance. Firms need to remain agile in responding to these changes while ensuring transparency and stability.

5. The Interplay of Globalisation and Risk Management

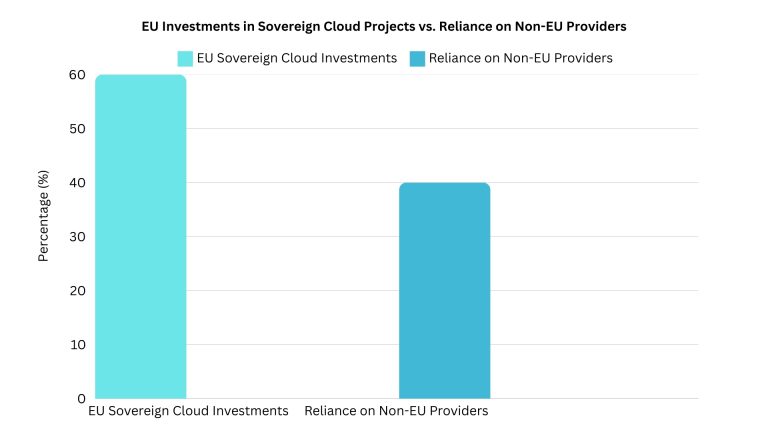

The EU financial system is increasingly interconnected with global markets, with significant reliance on non-EU providers for various financial services. While this interconnectivity fosters innovation and efficiency, it also introduces vulnerabilities, such as dependency risks and exposure to global market disruptions. For instance, in 2024, concerns over dependency on U.S.-based cloud providers prompted the EU to accelerate investments in sovereign cloud initiatives. In 2025, risk management will be a focal point as firms address these challenges and enhance resilience.

Here is an infographic illustrating the EU’s investments in sovereign cloud projects versus its reliance on non-EU providers.

6. The Expansion of Non-Bank Financial Institutions

The role of non-bank financial institutions (NBFIs) continues to grow, with their assets having tripled since the 2008 financial crisis. As NBFIs gain prominence in financing the economy, regulatory scrutiny is intensifying to address concerns about liquidity mismatches and leverage risks. In 2024, Allianz’s investment management arm expanded its private credit offerings, reflecting the growing influence of NBFIs in alternative financing. These institutions will need to strike a balance between innovation and compliance to thrive.

“NBFIs are redefining traditional financing but must tread carefully to maintain stability,” commented Oliver Bäte, CEO of Allianz, in a 2024 press release.

7. Economic Stability and Growth Prospects

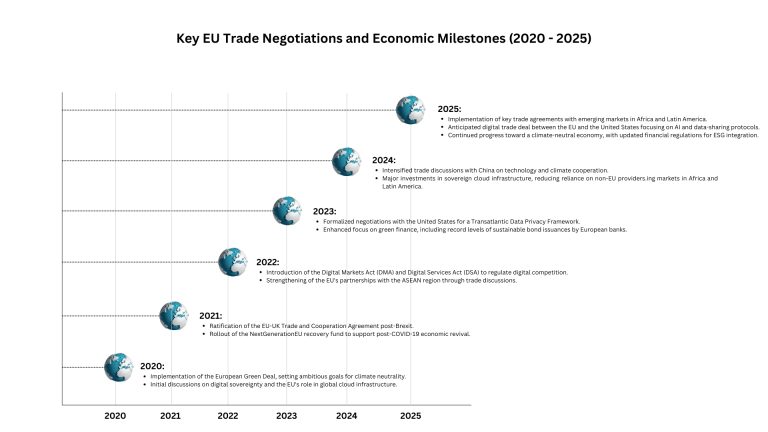

Economic forecasts for 2025 suggest modest growth in the EU, with GDP expected to rise by 1.6% and inflation easing to 2.2%. While this provides a stable backdrop for financial services, potential trade tensions, particularly with the U.S., could disrupt the economic equilibrium. In 2024, the EU’s negotiations on digital trade agreements highlighted the complexities of balancing economic growth with regulatory sovereignty. Firms must stay vigilant, monitoring global economic trends and adapting their strategies accordingly.

8. Driving Sustainability Initiatives

As climate risks and sustainability become central to global priorities, the financial sector is under pressure to align with these imperatives while leveraging opportunities in the green transition. Key factors driving this trend include:

- Regulatory Momentum: Governments and regulators worldwide are implementing stricter ESG reporting and sustainability disclosure requirements, making compliance a necessity.

- Market Demand: Investors and stakeholders are increasingly prioritizing sustainability, pushing firms to adopt green finance solutions and demonstrate responsible practices.

- Climate Risks: The escalating frequency and severity of extreme weather events make climate risk management an urgent priority for portfolio stability and resilience.

- Innovation in Green Finance: Green bonds, sustainability-linked loans, and carbon markets are growing rapidly, presenting lucrative opportunities for forward-thinking institutions.

- Global Net-Zero Goals: Institutions are playing a critical role in funding the transition to a low-carbon economy

9. Conclusion: Navigating the Future

The financial services industry in 2025 will be defined by its ability to adapt to technological, regulatory, and economic changes while addressing sustainability and customer needs. As technology continues to transform the sector, firms that prioritise innovation, compliance, and risk management will emerge as leaders. The road ahead is both challenging and full of opportunity, requiring a proactive approach to stay ahead of the curve.

We at Aspect Advisory are well-positioned to guide businesses through these transitions. With expertise in regulatory compliance, digital transformation, and sustainable finance, Aspect Advisory provides tailored solutions to help clients navigate complex challenges and seize emerging opportunities. Whether it’s leveraging AI to enhance customer experiences, aligning operations with ESG goals, or addressing regulatory requirements, Aspect Advisory partners with organisations to drive growth and resilience in the ever-evolving financial landscape.

By focusing on these trends, stakeholders can better position themselves to navigate the complexity of the financial landscape and capitalise on emerging opportunities.

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()